Brain Food #718

It catches up in the end

Thoughts of the day

The stock market can be an immensely interesting mirror of human psychology and life principles.

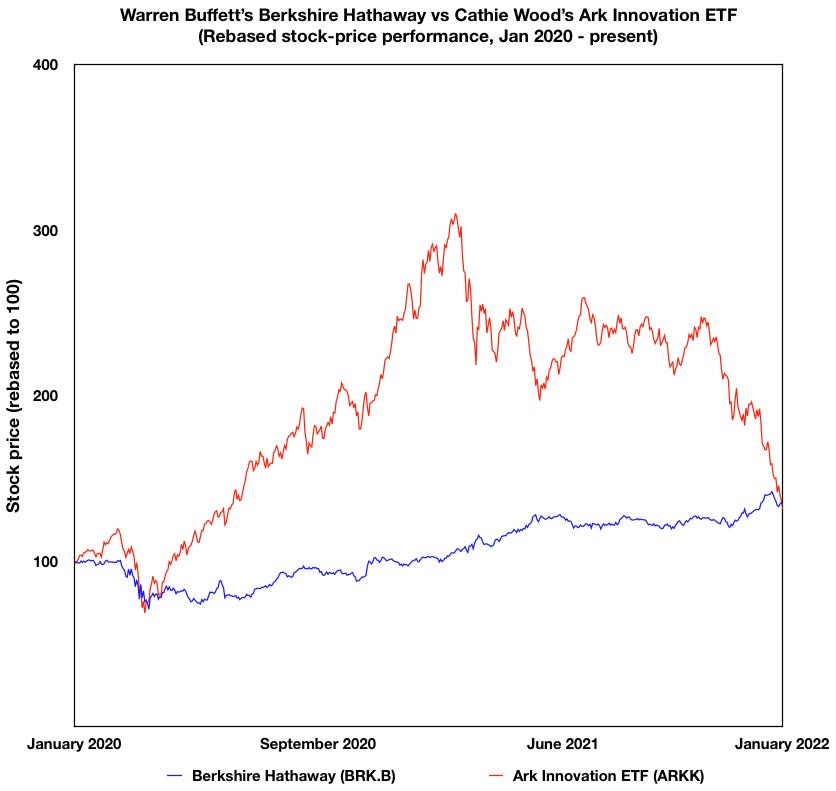

After nearly two years, Warren Buffett's Berkshire Hathaway has caught up with and, until last week, was outperforming Cathie Wood's Ark Innovation ETF (ARKK). The latter focuses on growth stocks (including high-growth, but also high-volatility and, sometimes, overhyped tech companies), the former on a value strategy which includes choices that yield slow, steady returns.

The graph below shows the performance of the two funds since 2020. Despite Ark’s meteoric growth in 2020, it waned in 2021, and then tumbled to meet Berkshire Hathaway, which was steadily increasing in the meantime.

As Jean-Jacques Rousseau wrote, “Patience is bitter, but its fruit is sweet.” It is true that patience can be a painfully slow game, but it catches up in the end.

Thank you for reading today’s Brain Food. Brain Food is a short daily newsletter that aims to make you think every day, without taking up too much of your time. If you know someone who would like it, why not forward it to them? And if you have just come across Brain Food, you can subscribe to it below:

For longer thoughts and Brain Food highlights from the archives, visit Medium.